CCM weathers 2020 market crash

Last semester, Coyote Capital Management (CCM) oversaw around 2.3 million dollars in financial assets. When the pandemic hit, the market slowed, reducing CCM’s investments. However, through the reallocation of money since then, CCM’s portfolios are now worth 2.52 million.

Zach Motl, CCM President, said right after students returned home, the market turned. He said CCM for the most part has long-term buy and hold-strategies, though the organization did reallocate money into investment sectors which were hit hard.

Some of the money CCM reallocated was from the cash portion of its portfolio. Motl said the cash allows the organization to capitalize on buying assets from companies which CCM considers good investments but whose stock prices have decreased.

“We took a significant loss — pretty much everyone did when the market crashed,” Motl said. “After that, we did a lot of analysis, we did a little bit of shifting things around, reallocating things a bit … and because of that the entire market has begun to come back faster than we’ve ever seen before.”

Alexander Walter, CCM’s portfolio manager, said the market went downhill quickly. He said CCM’s portfolios have recovered since March, even though some of its sectors, like natural resources and finance, have yet to fully recover.

“March 27, we saw a drop form about 2.3 million dollars to 1.664 million dollars at our lowest point on March 24. Things have really only gone up from there,” Walter said.

As of Aug. 28, Motl said CCM’s portfolios are worth 2.52 million dollars.

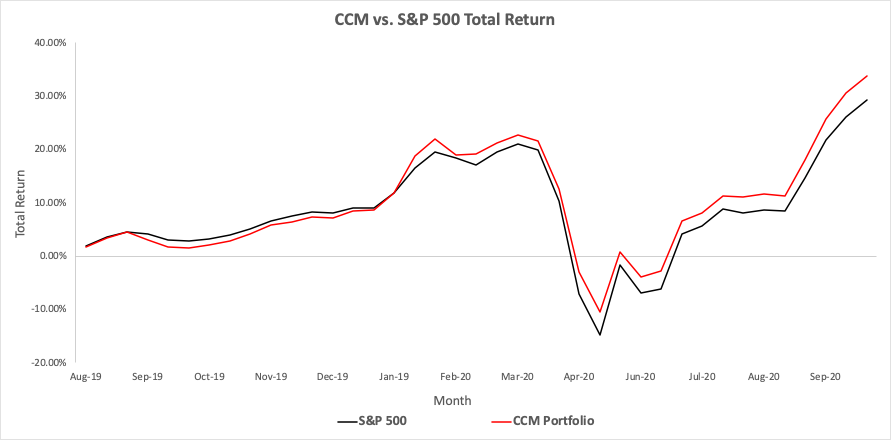

Walter said CCM allowed its most outperforming sectors to be overallocated during the crash, which he thinks is what led to the portfolios’ current value. He also said CCM’s portfolios are actually outperforming the market.

“All portfolios combined were up 7.01%,” Walter said. “The market index that we compare our portfolio to, the S&P 500, is only up 5.15%.”

The situation is unique, Motl said, because the organization is trading and reallocating money more than usual, which allows members to ask difficult questions about finance and investing.

Motl said while the goal of CCM is to make good investments and big money, it exists even more to help students understand upper-level finance courses, to teach students how to invest, and to build networks between students of all years.