Students deserve stimulus checks, just like everyone else

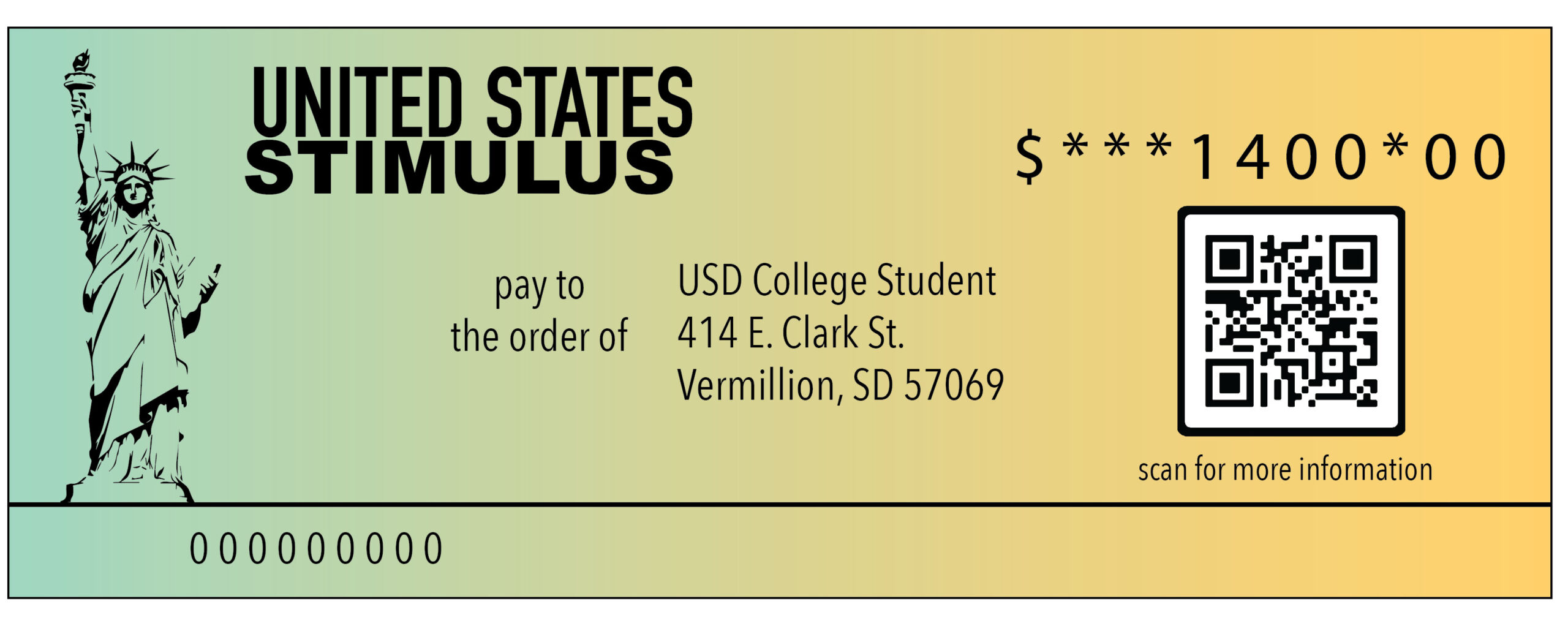

Currently, more and more people are finding that they’ve received the latest stimulus check of $1,400. This check is different from past checks as it includes people who were previously excluded, like college-aged students of 18 years and older who are claimed on their parent’s taxes.

These students were excluded from the previous stimulus checks, presumably because they’re claimed by their parents. This might look like these students are taken care of by their parents, but the reality is that many of these students actually have their own bills and financial needs that many parents don’t help cover.

Students beyond their second year of college tend to live off-campus, therefore signing a lease that requires rent payments as well as covering any utilities not included. Living off-campus also means that many of these students are buying their own food instead of setting up a meal plan with the university and eating on-campus. There are also car and phone bills to pay on top of living costs.

The misunderstanding is that people over 18 years of age that are claimed by their parents are completely dependent, but in actuality most are still working and paying for things on their own.

Some students in this category might receive financial help from their parents, but many students still have to pay for their own college.

According to US News, the average amount students borrow for student loans has exceeded $30,000. This means that the average amount that students are borrowing has increased by over $6,000 in the last 10 years. As colleges continue classes through the pandemic and student loans continue to rise, this age group could have paid back some of this increasing debt with these stimulus checks.

Combining the first two stimulus checks this group of people was excluded from equals $1,800, and if the most recent check of $1,400 was added as well, that equals a total of $3,200. With the average student loan debt now exceeding $30,000, the total of these stimulus checks could help pay off approximately 10% of these loans.

While adding this group of people to the most recent stimulus check definitely helps, it doesn’t quite make up for the $1,800 that they missed out on.

On top of these bills and fees, most people this age have to find whatever jobs they can without a college degree. This results in serving food, cashiering, cleaning jobs and other odd jobs available. While these jobs help students get by, many of them were not considered to be essential and therefore closed at the beginning of the pandemic. This then takes away the main source of income for these people, and if they’re claimed by their parents and are excluded from the stimulus checks, they have no real way to pay their bills and living costs.

While these students missed out on last year’s stimulus checks, some are receiving them now on their tax returns. That added to the current round of stimulus checks will help students, but we need to start acknowledging the financial struggles of students in college.

Just because students are claimed on their parents’ taxes doesn’t mean they are truly dependent, and this latest round of stimulus checks is a step in showing that.